WASHINGTON — National Taxpayer Advocate Erin M. Collins today released her 2025 Annual Report to Congress, finding that taxpayers generally fared well in their dealings with the IRS in 2025 and that most taxpayers are likely to have a smooth experience in 2026. However, the report cautions the upcoming filing season is likely to present greater challenges for taxpayers who encounter problems.

“Among the reasons the 2025 filing season went well was that the IRS had its largest workforce in many years and faced no major tax law changes that required implementation during the filing season,” Collins writes. “Entering 2026, the landscape is markedly different. The IRS is simultaneously confronting a reduction of 27% of its workforce, leadership turnover, and the implementation of extensive and complex tax law changes mandated by the [One Big Beautiful Bill] Act, many of which apply retroactively and require significant IRS programming, guidance, changes to tax forms and instructions, and taxpayer education.”

Despite these challenges, Collins says most taxpayers will be able to file their returns and receive their refunds without delay. “For the significant majority of taxpayers who file their returns electronically, who include their direct deposit information, and whose returns are not stopped by IRS processing filters, the process will be seamless,” she writes. “Their returns will be processed quickly, and if they are due a refund, they will receive it without delay.” However, she notes “the success of the filing season will be defined by how well the IRS is able to assist the millions of taxpayers who experience problems.”

During 2025, the IRS processed more than 165 million individual income tax returns. About 94% were submitted electronically, and 6% (about 11 million) were filed on paper. Approximately 104 million taxpayers (63%) received refunds, with an average refund amount of $3,167. While most refunds were issued timely, about 3.6 million taxpayers received their refunds beyond the IRS’s normal processing time, with an average wait time of 7 weeks for e-filers and 14 weeks for paper filers.

In addition, longstanding delays in resolving identity theft victim assistance cases persisted during 2025, with hundreds of thousands of taxpayers waiting an average of more than 21 months for the IRS to resolve their cases and issue refunds due. Particularly for lower income taxpayers, these delays can create or exacerbate financial hardships. Collins has previously called these delays “unconscionable,” and her report reiterates a prior recommendation to keep IDTVA employees focused exclusively on identity theft casework until the average case resolution time is reduced to 90 days.

The report says the combination of staffing reductions and significant retroactive changes in the tax law has created challenges for taxpayers and the IRS alike. It also examines the challenges the IRS will face in balancing telephone service with case processing and the potential risks of outsourcing the processing of millions of paper-filed tax returns.

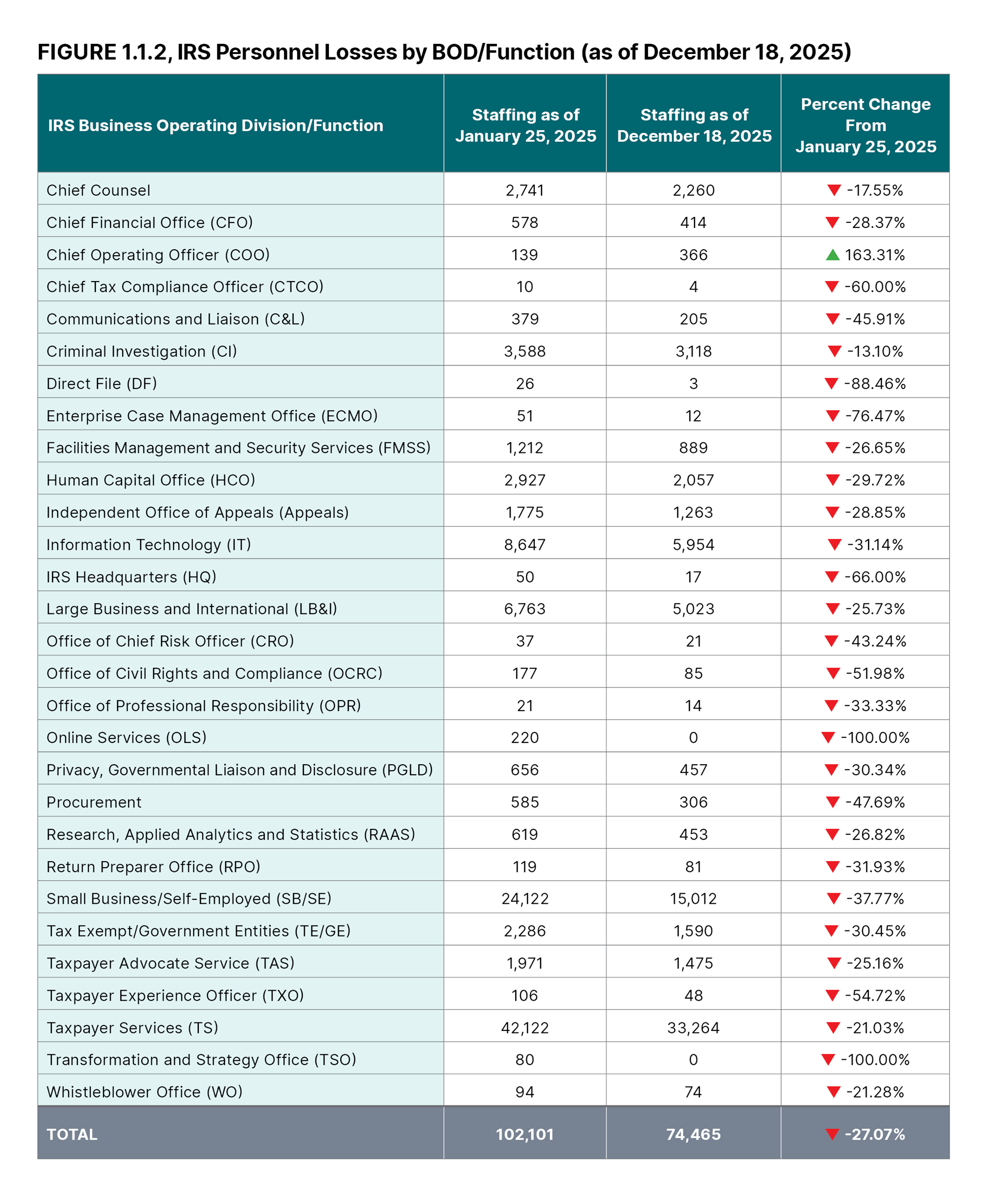

The IRS started 2025 with about 102,000 employees and finished with about 74,000, a reduction of 27%. Reductions were made in virtually all IRS functions, including Taxpayer Services, as shown in the following table:

Of particular importance for taxpayer service are customer service representatives who answer telephone calls and process taxpayer correspondence and casework. The IRS generally receives over 100 million telephone calls and several million pieces of taxpayer correspondence each year. In 2025, the number of CSRs was reduced by 22%. Although the IRS backfilled some of these positions late in the year, the number of CSRs remains substantially lower than last filing season, and the new hires have less experience than the employees who departed.

Of particular importance for taxpayer service are customer service representatives who answer telephone calls and process taxpayer correspondence and casework. The IRS generally receives over 100 million telephone calls and several million pieces of taxpayer correspondence each year. In 2025, the number of CSRs was reduced by 22%. Although the IRS backfilled some of these positions late in the year, the number of CSRs remains substantially lower than last filing season, and the new hires have less experience than the employees who departed.

“To fulfill its mission, the IRS must align hiring decisions with operational needs and emerging challenges, rather than target a predetermined staffing level,” Collins writes. “Workforce planning should be guided by the work necessary to provide timely, accurate service to taxpayers and to protect taxpayer rights, as well as by the most effective ways to deliver those outcomes.”

The One, Big, Beautiful Bill Act made more than 100 changes to the tax code. While some will not take effect until 2026, key provisions were made retroactive to the beginning of 2025 and must be reported on 2025 tax returns filed during the current filing season. “While the OBBB Act is generally taxpayer-favorable in that it expands eligibility for certain deductions and benefits,” Collins writes, “the deductions and benefits are subject to complex eligibility rules, income thresholds, and phaseouts that will be difficult for many taxpayers to understand and for the IRS to administer accurately during the filing season.”

These benefits include new tax deductions for tip income, overtime pay, and interest paid on auto loans, as well as an additional standard deduction for senior citizens and an increased maximum deduction for state and local taxes.

The report highlights the complexity of these provisions. To cite one example, the following requirements must be met for a taxpayer to claim a deduction for interest paid on auto loans:

In addition, the deduction is capped at $10,000 and begins to phase out for taxpayers with modified adjusted gross incomes over $100,000 for single taxpayers and $200,000 for married filing jointly taxpayers at a rate of 20% for each additional dollar of income, fully phasing out for single filers with MAGI over $150,000 and joint filers with MAGI over $250,000.

Other changes in law have similarly complex requirements. The report warns these changes are likely to create taxpayer confusion, generate more taxpayer calls to the IRS, and potentially result in errors that will lead to refund delays.

Historically, the IRS has used a “Level of Service” telephone measure as a primary taxpayer service metric. The report highlights the limitations of that measure. Writes Collins: “I recommend the IRS eliminate the LOS as a benchmark performance measure and replace it with a suite of performance measures that better reflect the taxpayer experience and drive improvements in the quality of taxpayer service.”

As the IRS is unable to shift its CSRs seamlessly between answering the phones and processing correspondence, CSRs during the filing season have spent as much as 34% of their time simply waiting for the phone to ring, the report says. During the 2023 filing season, that translated to nearly 1.3 million hours of idle time. CSRs closed an average of 1.21 cases per hour in the tax adjustments inventory that year. If the telephone idle time of nearly 1.3 million hours had been allocated to resolving paper inventories, the IRS would have processed and closed more than 1.5 million additional cases.

“It is not practical to eliminate all idle time, but if the IRS set a lower LOS goal, it would get more bang for the buck,” Collins says in the report. “[CSRs] would have considerably less idle time and would resolve more taxpayer issues more quickly. In essence, an overly high LOS can create a self-perpetuating cycle: Customer service representatives spend significant time idle rather than resolving underlying account issues, those unresolved issues prompt taxpayers to call repeatedly or submit duplicative correspondence, and the resulting increase in calls and correspondence further strains IRS resources and delays resolution.”

“A high LOS achieved at the expense of timely case resolution can worsen the overall taxpayer experience rather than improve it, and combined with recent workforce reductions, it is likely to create a big hole from which the IRS will spend months or years digging out,” the report says. “Because telephone service is often the gateway to resolving tax issues, its effectiveness depends not merely on whether calls are answered but also on whether taxpayers receive timely, accurate, and complete assistance that resolves their concerns. Measuring and improving the quality of telephone service is therefore essential to protecting taxpayer rights, promoting voluntary compliance, and ensuring efficient tax administration.”

While most taxpayers now file their tax returns electronically, about 11 million individuals continue to file on paper each year, and the IRS receives an additional 11 million paper-filed employment tax returns. In April, the IRS launched a “Zero Paper Initiative” to digitize a wide swath of the agency’s operations, including return processing. Rather than do the work itself, the IRS entered into contracts with several private companies to scan returns using optical character recognition technology. The report cautions the IRS “not to put all its eggs in one basket by eliminating or severely reducing the Submission Processing employees needed to process paper returns before validating technology performance.” While the “Zero Paper Initiative” approach has the potential to reduce processing times for paper returns, the report says it introduces operational and confidentiality risks.

“It was just a few years ago that an employee of an IRS contractor, Charles Littlejohn, stole the return information of thousands of taxpayers and sent it to media outlets,” Collins writes. In the report, she recommends strengthening penalties on contractors if they fail to protect taxpayer return information.

The 10 most serious problems discussed in the report include the following:

Refund delays and unclear and confusing disallowance notices harm taxpayers and jeopardize their rights to administrative and judicial review. During FY 2025, the IRS processed about 1.6 million business amended returns and took an average of over 13 months to do so. Although delays for individual amended returns were less extreme, it took the IRS an average of over 5 months to process 3.7 million such returns. Refund delays can cause financial harm for taxpayers, as businesses may need their refunds for cash flow purposes and individuals may require refunds to pay their basic living expenses. When the IRS disallows a refund claim, it often issues a notice that is unclear and does not provide vital information, including the deadline by which the taxpayer must either file a refund suit in court or get the IRS to execute an extension of the filing deadline. TAS recommends the IRS take additional steps to automate the processing of amended tax returns so it can process them more quickly, improve the clarity of the information it provides in notices of claim disallowance and establish procedures to execute Form 907, Agreement to Extend the Time to Bring Suit, to protect taxpayers from missing deadlines and forfeiting their refunds due to IRS delays.

Outdated paper processes and procurement delays harm taxpayers. The IRS’s challenges in modernizing its technology systems are longstanding, and the need to digitize its operations is becoming more critical. When the IRS processes paper-filed original tax returns, amended tax returns, and taxpayer correspondence through paper processing methods, taxpayers must wait longer to receive their refunds or correspondence responses. In addition, transcription errors are often made that create problems and often require additional back-and-forth between taxpayers and the IRS to resolve. The IRS’s struggles in modernizing its technology are largely attributable to the agency’s large number of data systems and the way they interact with each other. To address the problems created by paper filings, the agency has made its Zero Paper Initiative a top priority. TAS recommends the IRS conduct a comprehensive study of the pros and cons of contracting with external vendors as compared with building in-house capacity staffed by IRS employees to perform scanning and other digital operations, and it recommends the IRS refine its procurement processes to reduce bid protests and consequent delays.

The IRS does not accurately measure the quality of its telephone service. Telephone service remains the primary method by which taxpayers contact the IRS to ask questions or resolve account problems. Taxpayers called the IRS over 100 million times last year. Despite the importance of this communication method, the IRS does not have adequate measures to assess whether taxpayer needs are being met. Historically, the IRS has published the LOS performance measure, which TAS, the Treasury Inspector General for Tax Administration and others have criticized because most calls the IRS receives are excluded from the measure, and the measure does not capture the quality or resolution of the calls. During 2025, the IRS routed about 35 million calls to new voicebot technology; these calls also were not included in the IRS’s benchmark LOS telephone performance measure, except for calls transferred to telephone assistors. Taxpayers generally were not satisfied with the voicebots. In taxpayer satisfaction surveys, only about half of taxpayers reported that they found the “Where’s My Refund?” bot helpful and only 40% found the “Where’s My Amended Return?” bot helpful. TAS recommends the IRS implement comprehensive outcome-based measures for all telephone lines, including measurement of “first contact resolution.”

Other problems identified in the report include concerns about the independence of the IRS’s Independent Office of Appeals; the limited functionality of online accounts used by tax professionals; IRS delays in responding to Freedom of Information Act requests submitted by taxpayers to obtain their own tax records; deficient procedures for maintaining the IRS’s Centralized Authorization File for tax practitioners; misinformation about tax compliance on social media; compliance challenges faced by U.S. taxpayers living abroad; and the ineffectiveness of IRS processes designed to offer taxpayers relief from international withholding requirements.

The National Taxpayer Advocate’s 2026 Purple Book proposes 71 legislative recommendations intended to strengthen taxpayer rights and improve tax administration. Among the recommendations:

The report also contains a taxpayer rights and service assessment that presents performance measures and other relevant data, a description of TAS’s case advocacy and systemic advocacy operations, and a discussion of the 10 federal tax issues most frequently litigated in court last year.

Visit www.TaxpayerAdvocate.irs.gov/AnnualReport2025 for more information.

TAS is an independent organization within the IRS that helps taxpayers resolve problems with the IRS, makes administrative and legislative recommendations to prevent or correct problems and protects taxpayer rights.

Learn more at TaxpayerAdvocate.irs.gov or call 877-777-4778. Get updates on tax topics by following TAS on social media at: facebook.com/YourVoiceAtIRS, X.com/YourVoiceatIRS, LinkedIn.com/company/taxpayer-advocate-service and YouTube.com/TASNTA. For media inquiries, please contact TAS Media Relations at TAS.media@irs.gov or call the media line at (202) 317-6802.

Subscribe to receive the National Taxpayer Advocate’s blogs about key issues in tax administration in your inbox or visit the TAS website to read her previous blogs.

Want to get the latest tax news, learn more about taxpayer rights, and upcoming TAS events while looking at cute dogs and pop culture references? Look no further than TAS Social Media. Follow, like and share our content to help spread the work on how we advocate for taxpayers!